Unconventional Success is a portfolio with a pedigree. It was designed by David Swensen, chief investment officer of Yale University. • His investing record is the best in the Ivy League. Swensen’s strategy for individuals, however, is not the same as his university’s endowment fund. Instead, he prescribes a super-simple Lazy Portfolio, ironing out complexity by holding only six index funds.

Figure 1. The Unconventional Success Portfolio is actually a fairly conventional example of strategies called Lazy Portfolios. Photo by Everett Collection/Shutterstock.

• Part 10 of a series. Parts 1 through 9 appeared on June 11, 13, 18, 20, 25, 27, 29, 30, and July 9, 2019. •

We saw in Part 1 of this series that a number of basic investment strategies called Lazy Portfolios (static asset allocation portfolios) developed around the 1990s. These simple formulas were intended to take advantage of the relatively new phenomenon of index mutual funds that tracked a wide variety of US and international asset classes.

The Unconventional Success Portfolio was developed by David Swensen, chief investment officer of Yale University’s giant endowment fund. As an institutional investor, he’s drawn praise for his realization that colleges have an unlimited life span. They can profit, therefore, from assets that take many years to pay off, such as tree farms and private-equity firms.

This long-term approach has served him well. According to an article in the Journal of Wealth Management, Swensen delivered the best record of any Ivy League endowment fund managing more than $1 billion in assets. In the 17 fiscal years ending June 30, 2015, the top three universities’ annualized total returns were:

12.3% — Yale University

11.8% — Princeton University

11.7% — Duke University

By comparison, the S&P 500’s annualized total return during the same period was only 5.5%.

In addition, the three colleges lost during their worst fiscal years only such relatively tolerable amounts as 24.6%, 23.5%, and 24.3%, respectively. The S&P 500 lost a gut-wrenching 35.9% in its worst fiscal year.

Swensen’s 2005 book for individual investors, Unconventional Success, didn’t recommend that people try to duplicate Yale’s methods. Small investors can’t access high-net-worth private-equity funds or other sophisticated investment opportunities that are available to universities. Instead, his book specified a much different approach — a super-simple Lazy Portfolio that holds only six index funds in proportions that never change.

Unconventional is one of eight so-called Lazy Portfolios that have been tracked in real time by MarketWatch.com for the better part of two decades. In the 15 years ending Dec. 31, 2017, the strategy had the third-highest return of the eight portfolios, returning 8.68% annualized, according to MarketWatch’s statistics, as shown in Part 1. However, that underperformed the S&P 500, which returned 9.93%, including dividends. The benchmark did better than any of the Lazy Portfolios.

Swensen’s model has also been tracked in real time for several years by My Plan IQ, a financial website that rates 401(k) plans and other investment strategies. The portfolio can also be simulated over a recent 43-year period by Mebane Faber’s Quant simulator, as shown below in Figure 2. The Quant program is available as a free bonus with a subscription to the Idea Farm Newsletter ($399 per year).

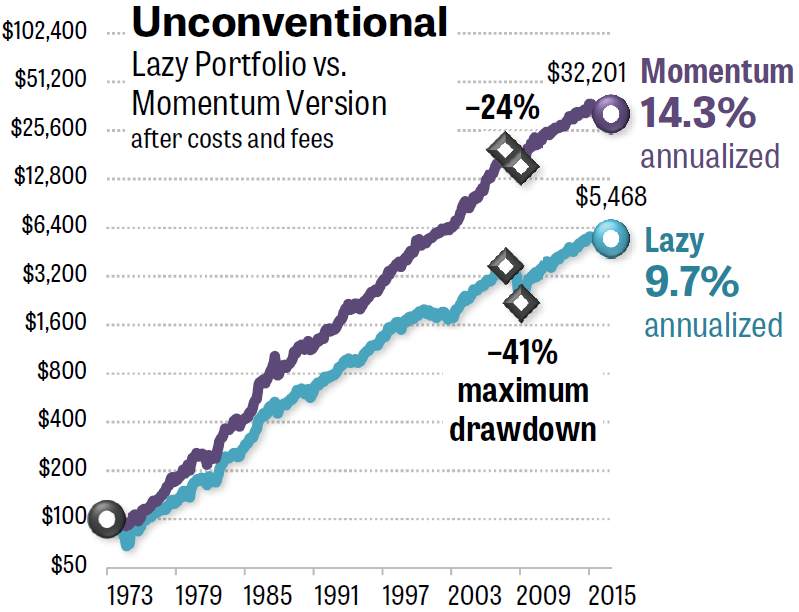

Unfortunately, Unconventional was the second-worst-performing model of the nine Lazy Portfolios that are described in this series of StockCharts articles, based on Quant’s 43-year simulation. Unconventional had a long-term annualized total return of 9.7%, as shown below in Figure 2. That was far less rewarding than other simple models, such as the Coward’s Portfolio that we saw in Part 2, which delivered 10.9% annualized. During the same 43-year period, the S&P 500’s total return was 10.0%.

The good news is that a single additional step, called the Momentum Rule, improved Unconventional’s theoretical return to a very respectable 14.3%.

Figure 2. The Unconventional Success Portfolio would have given investors 4.6 points more annualized return if followers held only the strongest three funds each month, compared with constantly holding every fund all the time. Source: The Idea Farm’s Quant simulator.

All of the Lazy Portfolios in this series were enhanced using exactly the same Momentum Rule, as follows:

- At the end of each month, you average the total gain of each asset class over the past 3, 6, and 12 months.

- In the following 30 days, you hold only the three asset classes with the strongest average return.

This Momentum Rule is similar to a formula Faber published in a 2013 white paper at the Social Sciences Research Network (SSRN).

The six asset classes that Unconventional holds, and the percentages for each one, are:

- 30% all US stocks

- 15% developed-market stocks

- 5% emerging-market stocks

- 20% US real-estate investment trusts (REITs)

- 15% long-term Treasury bonds

- 15% Treasury inflation-protected securities (TIPS)

For more information on these asset classes and specific funds that index them, see the breakdown at My Plan IQ.

Starting with $100, the Lazy Portfolio gave you only $5,468 after 43 years. The momentum version ended up giving you $32,201 in your account — almost six times the ending value. (The proportions are the same whether you start with $1,000 or $100,000 or any other amount.)

In my simulations, most of the portfolios in this series were charged 0.11% per year, representing today’s annual fees of the ETFs each portfolio would require. In addition, the momentum portfolio was charged 0.10% round-trip each time one ETF was sold and a replacement was purchased. (The Lazy Portfolios were charged nothing for trading expenses, although annual rebalancing would have imposed a small cost.)

Swensen did not respond to a request for comment.

This concludes my series of articles analyzing nine of the most popular Lazy Portfolios. In my concluding article, we’ll add up our findings. Best of all, you’ll see the best portfolios we can create using today’s complete set of asset classes, and how simple rules greatly improve these portfolio’s performances.

• The conclusion appears on July 16, 2019.

With great knowledge comes great responsibility.

—Brian Livingston

Send story ideas to MaxGaines “at” BrianLivingston.com