We can look and look at data and wind up perfectly comfortable with our observations. But how can we be sure we really understand what we’re seeing? • The human mind has its own way of presenting the external world to us, just when we think we have everything figured out. Compensating for the conclusions we jump to is essential for our investing success.

• More than 100 million households in the US, Canada, and other countries hold 401(k), IRA, and similar savings accounts. The vast majority of 401(k) participants cannot buy individual stocks — only index funds — and can make no more than one or two portfolio changes per month. Despite restrictions like these, you can use 21st-century financial breakthroughs to enjoy market-like returns and more, with no fear of crashes. See my Muscular Portfolios summary.

Judgment calls are necessary for every investor. You can’t avoid making decisions. Deciding to invest in stocks rather than bonds, deciding to hold tight through a market crash, even deciding to visit this website today — all are decisions. A buy-and-hold investor is making a decision to follow a certain path, just as a day trader is making a decision to follow a different one. We can never say, “I made no decisions.”

Our brains make us think we are totally logical and rational when making financial buys and sells. Unfortunately, it just ain’t so. Just for one example, the new field of behavioral science shows that we can convince ourselves we know which stocks are going to go up and which are going to go down. But the reality is not so tidy. On average, the stocks that traders sell go up 9.0% in the next 12 months, while the stocks traders purchase as replacements go up only 5.7%. (Odean, 1998.) Our minds deceive us.

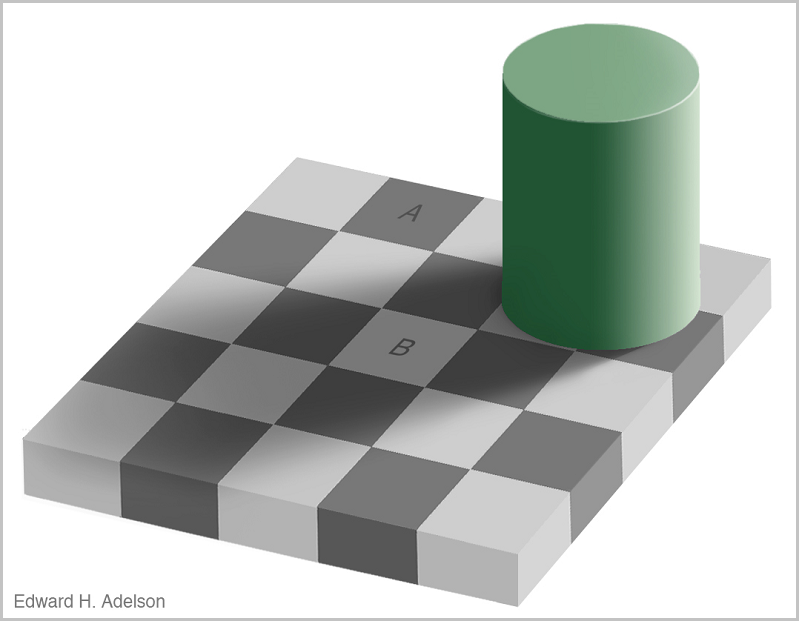

You may not think this applies to you. Fine. Let’s look at some simple examples. We’ll then move into the ways our minds work when we’re considering buying some securities. Please examine Figure 1.

Figure 1. Which area is lighter, Area A or Area B? Source: Edward Adelson/MIT.

Figure 1 shows a checkerboard with a green tower in one corner. Write down your answer to the following question:

Which area is lighter?

a. Area A

b. Area B

c. They are the same color.

d. It cannot be determined.

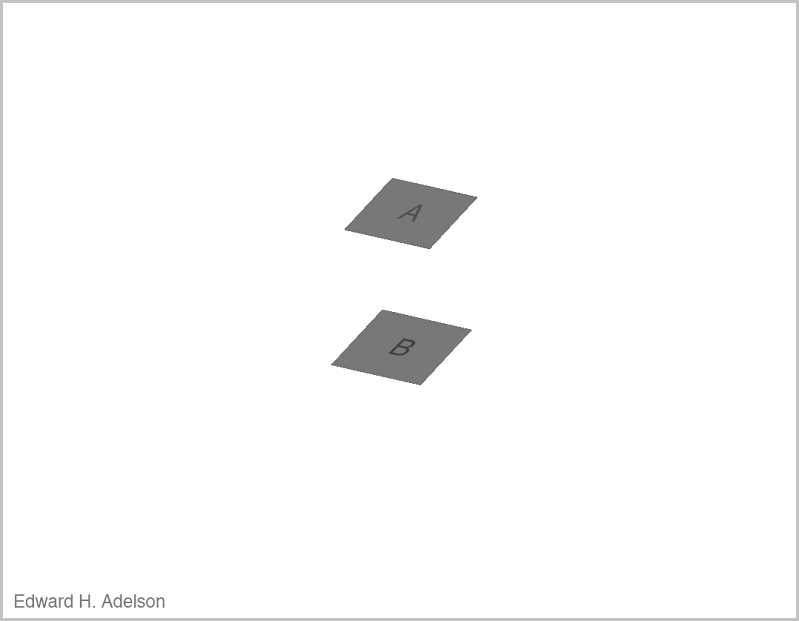

Are you ready? The answer is “c.” Both areas are exactly the same color. If you remove from the image everything but the two parallelograms, you can see that the two areas are both the same shade of Pantone Warm Gray. (In Photoshop, they are RGB color 120 120 120.) I’ve removed all of the confusing data for you in Figure 2.

Figure 2. Removing the extra information allows our brains to process the colors of Area A and Area B objectively.

Of course, it looks to our human eyes (when viewing the complex image) as though Area B must be lighter than Area A.

While preparing and presenting this image in my seminars on investing, I’ve looked at the original picture hundreds of times. It still looks to me like Area B is lighter than Area A! Simply knowing intellectually that our brain is fooling us does not prevent our mind from making us see what it wants us to see.

There’s a valuable explanation — and more evidence than the two areas really are the same color — at Edward Adelson and Ruth Rosenholtz’s MIT Perceptual Science Group proof page. I encourage you to take a look.

There’s a good reason why our brains pull this kind of trick on us. Without some form of automatic compensation, shadows could play havoc with our brain’s most accomplished skill: immediately recognizing faces and places. A hungry tiger in the shadows must still look like a hungry tiger if our forebears were going to be able to get away and survive. Our brains deceive us for our greater good.

When you think about it, there’s no board there. There’s no green tower there. There are only lines and shapes in a flat, two-dimensional drawing. But our brains need to be able to interpret the shapes as a 3-D board and tower. Otherwise, we could never play checkers in the dappled light underneath a pine tree.

This tendency for our brains to feed us a different picture than what is actually there, however, serves us poorly when our minds are exposed to financial data. In the next parts of this series, we’ll see how this affects us — completely beneath our awareness — and how we can harness it to make better investing decisions.

• Parts 2, 3, and 4 appear on Mar. 7, 12, and 14, 2019.

With great knowledge comes great responsibility.

—Brian Livingston

Send story ideas to MaxGaines “at” BrianLivingston.com