Would you like to know how to have an extra 1 trillion dollars in your pockets? Bogle did it — and you can benefit. • By some estimates, the Vanguard Group lowered fees so much that its shareholders alone saved a cool $559 billion. In addition, the ‘Vanguard Effect’ forced competing fund providers to collectively lower their fees an equal amount. Fees you don’t pay compound in your account.

• Parts 1, 2, and 3 of this column appeared on Jan. 15, 17, and 22, 2019.

In his personal life, Bogle was incredibly frugal. Maybe it was because he was born in the Great Depression. Bogle was only five months old on “Black Monday” — Oct. 28, 1929, when the Dow Industrials fell almost 13% in a single session, on its way to losing 89% by July 1932 — but the crash shaped his life. His grandfather’s business, a forerunner of American Can Co., was wiped out in the financial crisis, and Bogle’s family lost its home. He worked in his early years as a waiter, a mail clerk, and in other menial jobs, according to his obituary in the Philadelphia Inquirer.

By the time he’d been CEO of Vanguard for almost two decades and was already a multi-millionaire, his penchant for saving money was still paramount. Meeting a reporter in 1993 for a breakfast interview at a Philadelphia-area restaurant, Bogle declined to order the $5.95 buffet special. A quick glance at the menu was enough for him to compute that ordering the items separately would cost him less, according to an article in the New York Times.

This penny-pinching nature would turn out to serve individual investors very well. A number-cruncher at Bogleheads.org — the online home of Bogle’s enormous fan base — computed that Vanguard’s lower fees, and the compounded gains from investing the difference, had saved shareholders $559 billion in 40 years. And by forcing competing fund companies to lower their bloated fees, Vanguard collectively saved investors a total of more than $1 trillion, as calculated by Bloomberg ETF analyst Eric Balchunas in 2016.

Vanguard’s continuously ground away at its fund’s fees. It took time, but the company drove its expense ratios down from a weighted average of 0.66% in 1974 to only 0.10% in 2018, as I showed in Part 3. This cost Bogle billions of dollars of profits that he could have kept for himself — if he’d been the founder and CEO of an ordinary wealth-management firm.

Bogle’s net worth has been widely reported to be around $80 million. That’s a lot, but it’s a pittance compared to Blackstone co-founder Stephen Schwartzman’s $12.3 billion or Fidelity CEO Abigail Johnson’s $12.2 billion, both of whose companies are smaller than Vanguard. “So where did Bogle’s money go?” writes Bloomberg opinion columnist Nir Kaissar. “It went to Vanguard’s investors, who still pay a fraction of the fees charged by the average mutual fund four decades after the firm’s founding.”

Get the part of that $1 trillion that belongs to you

How do you benefit from the Vanguard Effect? Do you have to buy only Vanguard funds and no others?

Not at all. Bogle himself writes in Stay the Course:

“I could see that the uneven and often unpredictable efficiency of the market made the EMH [Efficient Markets Hypothesis] an unreliable basis for indexing. ... I later pioneered the CMH, the Cost Matters Hypothesis that (without often being cited) is now almost universally accepted.”

You don’t have to buy only Vanguard funds, but you do need to watch every dollar that you pay out in expenses. Costs matter. Those expenses might include unexpectedly high bid-ask spreads when you buy and sell stocks and ETFs, hidden fees in 401(k) plans and 529-type college savings programs, and other charges that seem small but add up.

The biggest unnecessary expenses people pay are advisory fees. Despite the Vanguard Effect, many “full-service” wealth-management firms still charge a 1% management fee. These companies then stuff their clients’ accounts with proprietary house funds that hide 2% annual fees in the fine print. That adds up to a 3% haircut per year, which is by no means as high as the industry can go.

“It is not unusual to see accounts from which as much as 5% annually is extracted,” writes author William Bernstein in The Four Pillars of Investing (2010).

Many individual investors unwittingly think 1%, 2%, or 3% annual fees are “reasonable” or “justified.” That might have been the case when stocks were expensive and difficult to buy and sell. But such fees are outrageous in today’s world of commission-free ETFs than have annual fees as low as 0.03%.

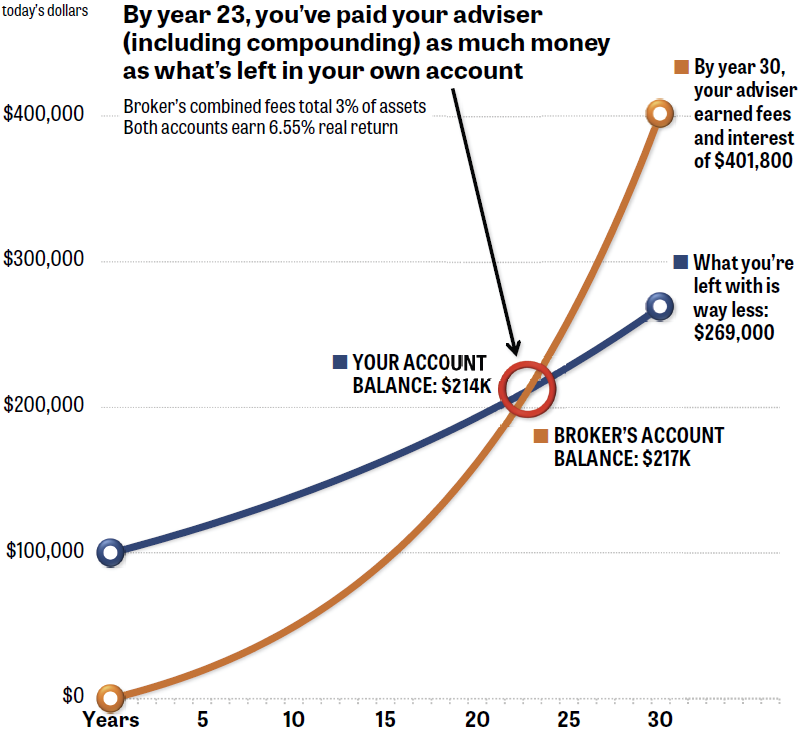

Figure 1. Even if the fees you pay for wealth management are “only” 3% of your assets per year, your adviser’s firm will earn more money from your account than you within only 23 years — less than a full working career. Based on Bernstein, The Four Pillars of Investing.

Figure 1 shows what happens when your account is managed by a firm with “only” 3% annual fees — including management charges and fund expense ratios combined.

The graph assumes you receive an inheritance of $100,000, perhaps on your 25th birthday. You invest it with a “full service” wealth-management firm.

Your 3% cost goes into the firm’s own account each year. Your account and the firm’s account both earn a 6.55% real return — about the same as the S&P 500 and the Baby Bear Portfolio described in Muscular Portfolios. However, you earn nothing on the fees you’ve handed over. In addition, the firm doesn’t charge itself any fees on the money it’s siphoned away from you.

Within only 23 years — when you’re now a 48-year-old middle manager, perhaps — the firm’s account holds more money than you do! That’s despite the fact that your account started with $100,000 and the firm’s account started with $0. In later years, the gap between the two accounts gets worse and worse.

It’s fees like these that Bogle spent his life fighting against. Whether or not you buy Vanguard funds, make sure you’re paying the lowest fees possible in whatever accounts you may have. Obviously, 401(k) plans and other employer-based savings programs must charge something in fees. But haircuts like 1%, 2%, and 3% per year are to be avoided in this age of ultra-low-cost investing.

I was honored to spend an hour with Bogle a couple of years ago in his office at the tiny Bogle Financial Markets Research Center in a corner of the Vanguard campus. I told him as soon as I sat down, “I’m not a salesman, and I’m not trying to sell you anything.” In his garrelous voice, which sounded like pickup truck tires on a gravel alley, he immediately barked, “So what are you doing here?!” I handed him an early draft of my book and explained that two chapters were about his investing strategies. (One chapter is on his super-simple 50/50 portfolio, which matches the S&P 500. Another is on a formula of his, first published in 1991, that projects the market’s future 10-year returns with surprising accuracy.)

Bogle graciously gave me a proof copy of a 2015 article that evaluated the 25 years of real-time predictions that his formula could now take credit for. With his death from cancer on Jan. 16, 2019, we won’t be enlightened with any new studies by Bogle. But his research center — which he established after leaving Vanguard’s board in 1999 at the suggested retirement age of 70 — will carry on his work.

If I’m half as productive at age 89 as Bogle was until the end, I’ll feel that I’ve accomplished something with my life. Rest in peace, Jack.

I’m taking a one-week break. My next Muscular Investing column appears on Feb. 5, 2019.

With great knowledge comes great responsibility.

—Brian Livingston

Send story ideas to MaxGaines “at” BrianLivingston.com