Top Robo-Advisor News – Vanguard is the Robo-Advisor With the Most AUM

Polaris Portfolios Expert Robo-Advisor Review

Polaris Portfolios is a digital wealth management platform built to outperform the market benchmarks and deliver exceptional client service. The platform was cofounded by Evan Kulak, Michael McDermott, and Grant White.

Unlike the majority of robo advisors that believe markets are efficient, Polaris believes that markets are inherently inefficient. Polaris Portfolios does not believe index funds offer the best returns on a risk adjusted basis. Rather Polaris believes that factor concentrated strategies, they term Style Alpha, offer the best risk adjusted returns. Polaris constructs its strategies according to a disciplined, rules based, and systematic process. Furthermore, portfolios are designed to minimize drawdowns.

Bonus Offer: Free Investment Management Software from Personal Capital

Polaris offers goal-based portfolios, life event based investing, option for ESG investing, institutional grade strategies, and volatility conscious portfolios. The investment options include 17 proprietary institutional grade equity strategies, 9 ETFs across various asset classes – fund providers are Vanguard , Blackrock, ETRACS, and SPDR. The investment options include real estate and commodities ETFs as well as a variety of equity style investing.

Similar to M1 Finance, this robo-advisor is for the investor that wants to go beyond the typical market matching index fund investment portfolio.

There is a $5,000 minimum investment account required. The fee structure is, 0.75% on accounts between $5,000 – $1,000,000; 0.50% on accounts greater than $1,000,000. The underlying ETF fees range from .10% to .50%. The proprietary funds have no underlying management fees.

Time will tell whether Polaris, with it’s unconventional investment style or not, will prevail. Short-term results and research don’t predict long term outcomes. I’d be cautious investing in an unproven strategy, especially with Modern Portfolio and efficient market theory owning years of proven investment research. Additionally, the company lacks PhD level investment expert input into the strategy.

Read on for the latest robo-advisor news…

“Should Retirees Use Robo-Advisers” by Anne Tergesen – WSJ.com

“Robo-advisory services that pair algorithms with human help have long been popular with millennials because of their low fees. But as baby boomers increasingly embrace the trend, too, many companies are adding features for retirees.

These services used to focus mainly on helping clients save for financial goals such as retirement. Now, they also offer tax-efficient strategies for turning nest eggs into steady streams of retirement income, as well as recommendations on Social Security, Medicare and long-term-care insurance.

Client demographics explain the shift. Industry leader Vanguard Group says 85% of those enrolled in its $93 billion Personal Advisor Services are over age 50. Among participants in Charles Schwab Corp.’s Intelligent Advisory service, 53% are older than 55.”

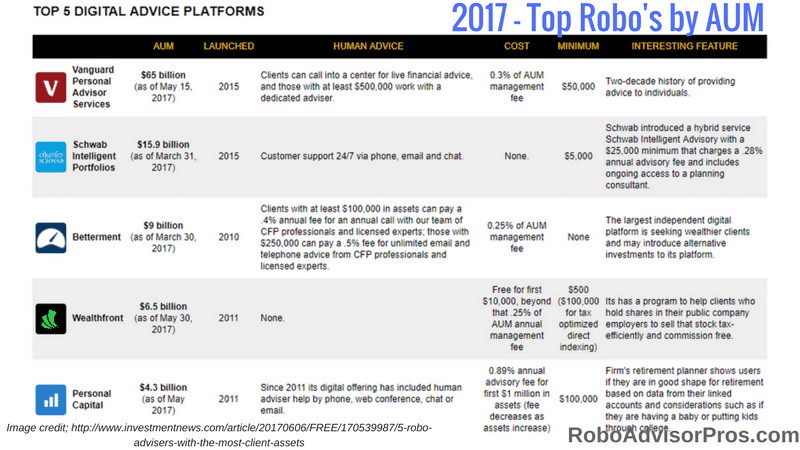

“5 Robo Advisors With the Most Client Assets” by Liz Skinner – InvestmentNews.com

“Think of Google’s dominance of search engines. That’s about how much America’s largest robo-adviser leads in the digital and mostly-digital financial advice marketplace. Today, these five top robo-platforms have a combined $100 billion in client assets, and the market is headed way up in the next few years. It’s projected to reach about $385 billion by the end of 2021, according to Cerulli Associates.”

“How Advisors Can Compete With Vanguard” by Cynthia Murphy – ETF.com

“At the Schwab Impact conference in Chicago this week, where some 5,000 advisors and wealth managers descended to talk about the latest in the industry, one question stood out: How do you compete with Vanguard?

In 2016 alone, when mutual fund and ETF providers collectively saw fresh net inflows of some $400 billion in assets, according to Morningstar data, Vanguard attracted a net of about $303 billion into its U.S. mutual funds and ETFs.

The firm’s version of a robo platform, Vanguard Personal Advisor Services, continues to grow, and today already boasts some $90 billion in assets under management (AUM) gathered in just three years. No other robo—or hybrid—comes close.”

“Robo Advisor Risk v Reward, International Diversification + Returns” by Barbara Friedberg – RoboAdvisorPros.com

“Finally, there’s data to get the scoop on various robo advisors. You can compare the risk vs returns of robo-advisors and view international diversification information. Then integrate this data with robo advisor performance results. If you’re considering investing with a digital investment advisor, here’s some useful data to guide you.

Robo-Advisor One Year Returns

Condor Capital invested funds in a number of robo-advisors. To keep things consistent, they allocated their investment money in a 60% stock v 40% bond allocation. The robo-advisor returns offered up Betterment as the #1 performer for one year ending September 2017 with a 11.97% return. Schwab eked out a close second with a 12 month 11.93% return. TD Ameritrade claimed third place in the one year performance race with a respectable 11.81% annual return.

Other robo-advisors with an annual return above 11% were E*Trade Hybrid with 11.61%, Fidelity Go with 11.46%, Vanguard robo investors earned 11.41%, Wise Banyan at 11.32%, E*Trade ETF with 11.29%, and SigFig gained 11.05%.

Returns are only one facet of the robo investing evaluation task.”

“Wells Fargo Launches Hybrid Robo-Adviser” by Ryan Neal – InvestmentNews.com

“Wells Fargo officially got into the digital advice market on Monday with the launch of Intuitive Investor, the bank’s new hybrid robo-adviser.

The offering combines digital access to a portfolio of ETFs designed by the Wells Fargo Investment Institute with access to human advice from a team of advisers from the firm’s wealth management division, Wells Fargo Advisors. Intuitive Investor will offer nine different strategies based on the client’s answers to a risk questionnaire and goals.

Don’t miss: Top 10 Money and Investing Apps

BANKING INTEGRATION

The robo integrates with Wells Fargo’s online and mobile banking services, meaning clients can open and fund a new Intuitive Investor account from their existing Wells Fargo app. Eddie Queen, Wells Fargo Advisors’ head of digital and automated investing, said making the experience fit seamlessly with the firm’s existing digital properties was a primary goal in developing the robo, and a reason it took longer to come to market than some competitors.

“We wanted to prioritize doing this right rather than doing it first,” Mr. Queen told InvestmentNews. He added that the integration will make it easier to introduce the robo to existing Wells Fargo customers, avoiding the marketing challenges and high customer acquisition costs that have plagued robo startups.”

PayPal Launches Robo Advising Automated Investment Service by Gina Hall – Silicon Valley Business Journal

“PayPal is hopping on the robo-investor bandwagon.

The San Jose-based company said Monday that it’s linking its platform Acorns Grow, an automated savings and investment service. PayPal users can make contributions to Acorns via their accounts and keep track of investments via the PayPal app.

“Acorns and PayPal are helping democratize financial services and offering innovative solutions to the people typically underserved by the current system,” the companies said in a statement.

The new features rolled out to select U.S. PayPal customers today and will be available for all U.S. customers by early 2018.

So why would anyone opt for robo-investing over an experienced human investment advisor? Lower fees and no conflicts of interest in fund selection are major attractions. Robo advisers often pursue passive investment strategies, primarily using mutual funds and exchange-traded funds, or ETFs, tied to investment indices.”

Robo-Advisor News Wrap Up

Don’t blink or you’ll miss a launch of another robo-advisor. It’s tough to keep up with this on-fire fintech industry. Investors, you’re the winners as fees decline and investment services advance. Stay tuned for current robo-advisor news. And if you’re seeking a robo-advisor, check out our Robo-Advisor Comparison Chart.